VAT reverse for participants from abroad

When you expect participants from abroad, it is possible to have the VAT reversed for these participants. In this article you can find more information about the laws for VAT for events.

Participants can then indicate on the payment page that they are eligible for reverse charge VAT, then a VAT number is requested and they receive a participant invoice with the VAT reversed.

This option is not enabled by default in your event, it is best to send us a message and we can turn this option on for you.

What does this look like for the participant

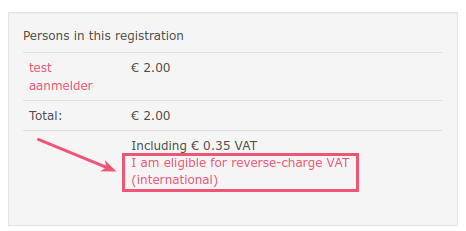

The payment page will show the following text:

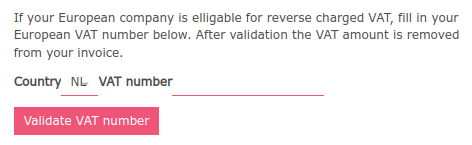

The participant can click on this and 2 extra fields will appear for the country and the VAT number: